—

Unlimited Supply of Dollars

—

“The Federal Reserve is committed to use its full range of tools to support the U.S. economy in this challenging time and thereby promote its maximum employment and price stability goals.

The Federal Open Market Committee is taking further actions to support the flow of credit to household and businesses.”

(US Federal Reserve, March 23, 2020)

The key is ‘unlimited dollar supply.’ As the economic crisis caused by the coronavirus in 2020 hit the world, the Federal Open Market Committee (FOMC) of the Federal Reserve System (FED), the central bank of the USA, issued the above statement.

Since then, huge amounts of dollars have been supplied to the world in an unprecedented short period of time in human history. As the United States freed money, Europe and Japan also began to release money unrestrictedly.

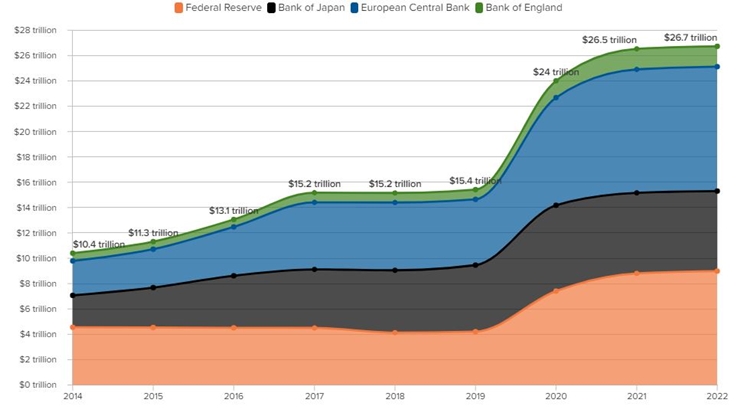

After the COVID-19 pandemic in 2020, the four major central banks in the US, Europe, UK, and Japan have released about $11.3 trillion (KRW 1,464 trillion) into the market through asset purchases. As a result, at the end of 2020, the market currency of the 12 major countries including them was 94.8 trillion dollars, an increase of 17.4% in one year.

The result was an increase in debt. As a result of the world's unlimited free money, the total global debt will reach $303 trillion in 2021, which is 3.6 times the sum of the world's GDP.

—

The two axes of economic management:

fiscal policy and monetary policy

—

Let's talk a little bit about basic economic theory. The government and central bank manage economic growth and prices through ‘fiscal policy’ and ‘monetary policy.’

○ Fiscal policy

Fiscal policy is the policy deciding how the government collects and uses taxes. During an economic expansion phase, taxes are raised and spending is lowered to prevent overheating. In times of economic downturn, the government stimulates the economy by lowering taxes and increasing spending.

○ Monetary Policy

Monetary policy is a policy by which the Central Bank regulates the amount of money (money supply) circulating in the market by adjusting the prime interest rate. In developed countries, price stability is the most important role of central banks.

In order to prevent inflation, central banks in each country collect money from the market by raising interest rates between central banks and commercial banks or by raising the reserve requirement ratio. When the amount of money available in the market decreases, the value of money increases and, conversely, the price of money decreases.

Let’s take a look at the underlying concepts.

—

Can unlimited dollar supply be a solution

to escape the COVID-19 crisis?

—

Former Federal Reserve Chairman Ben Bernanke (Source: USA Today)

When the U.S. financial crisis hit in 2008, Federal Reserve Chairman Ben Bernanke escaped the crisis by releasing unlimited money. Chairman Bernanke held that the 10 years of Great Depression of the 1930s was caused by the Central Bank's passive response.

The Fed (Central Bank of the U.S.) led by Chairman Ben Bernanke buys mortgage-backed securities held by commercial banks and supplies dollars to the market. In addition, it uses a low interest rate policy to circulate huge amounts of money into the market to promote consumption.

In other words, the Fed's goal was to create a virtuous cycle of ‘expansion of currency → cut interest rate → rise in asset prices → maximize the wealth effect* → increase consumption → increase product demand → increase factory utilization → create jobs → decrease unemployment → economic growth.’ This attempt worked. The crisis was overcome, and the game was revived.

*Wealth effect: Phenomenon where consumption increases when assets such as real estate and stocks rise

This crisis escape strategy was also applied to the 2020 Corona crisis. But the main difference is that it was applied on a vastly larger scale and much faster.

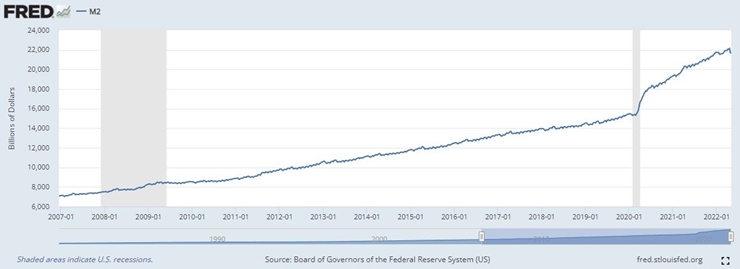

The U.S. has released about 3 trillion dollars (3,840 trillion won) in the three months from March 2020 alone. Compared to $4.5 trillion (5,760 trillion won) released over six years during the 2008 financial crisis, you can estimate how much money was released in a short period of time.

(M2 money supply in the U.S. - a sharp rise is observed in 2020)

―

Loose dollars and a rise in

stock, real estate, and coin prices

―

However, the market scene is different from that of a financial crisis, where the money is released but is not in circulation. This phenomenon is due to the shrinking rate of consumption and decreasing investment sentiment.

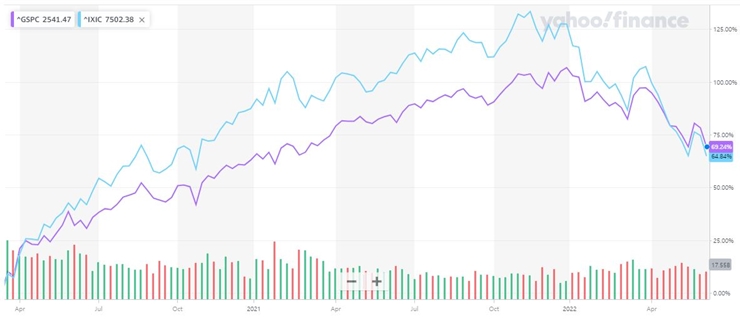

As a result, the huge sum of money released was directed into the asset market, such as stock and real estate. On top of that, virtual currency was also affected. In April 2021, its market capitalization spiked to the level of Apple Inc., one of the top world market capitalizations.

(U.S. stock prices have been on a sharp rise since March 2020.

Purple indicates S&P500 and blue indicates NASDAQ)

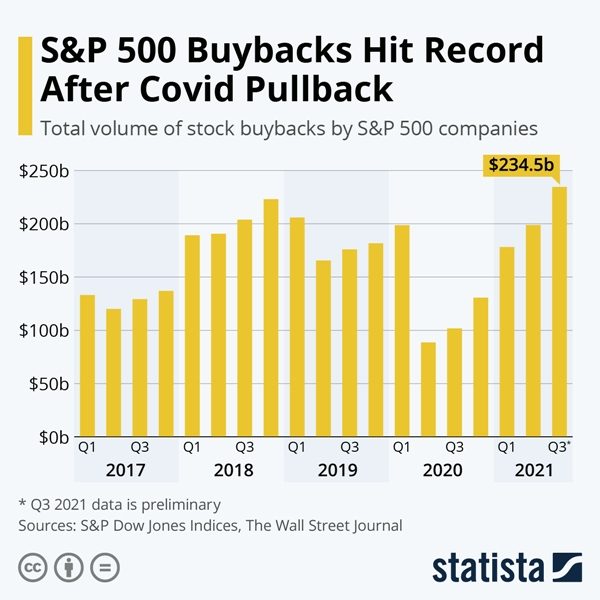

Global companies have been eager to buy back stock and pay dividends rather than investing in production and technological innovation with money borrowed at low interest rates.

What happens when a company buys back its stock? The number of stocks in circulation decreases, stock prices rise, and the income of global corporate executives and employees who receive a portion of their wages as stock rises.

(The U.S. Home Price Index has risen sharply since March 2020 as seen in this graph.)

(Treasury stock buyback trend of S&P 500 companies)

—

The Counterattack of Loose Money: Inflation

—

In the wake of oversupply of money, supply shortages due to the global shutdown and the Russia-Ukraine war, prices of key raw materials such as energy, steel, and food are skyrocketing.

The Global "Perfect Storm" Sparked by the War - Peace Issue

Agflation_Special Delivery Russia-Ukraine bombs flew right to my kitchen table - Peace Issue

(See previous SunHak Peace Prize articles on the rise in raw material and food prices)

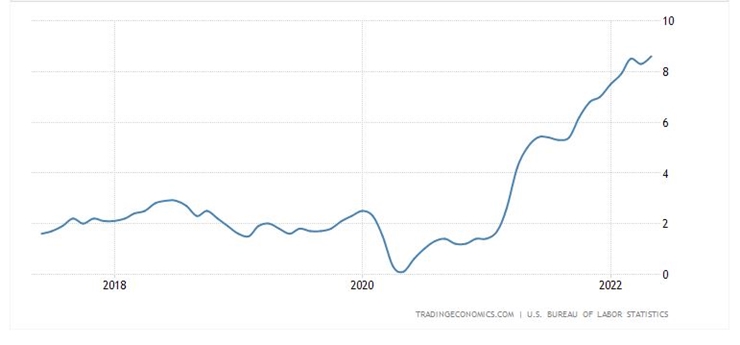

The US Consumer Price Index (CPI), an indicator of inflation, rose 8.6% in May 2022, the largest since 1981. The New York stock market plunged due to the first inflation in 41 years; day by day the market decline shows no signs of letup.

(U.S. Inflation Index)

Europe also faces a serious inflation crisis. Eurozone's Consumer Price Index (CPI), released last month, rose 8.1% year-on-year, said to be an all-time high. In response, the European Central Bank (ECB) is changing the zero-interest rate policy, which has remained for 11 years: In today's news it will raise in 0.25 percentage points in July.

Korea, which has raised the base rate since August last year, also suggested an additional rate hike from the current 1.75%, saying that if the timing of the rate hike is missed, the damage caused by inflation is likely to be greater.

Raising interest rates is like turning off the faucet where the money is pouring out. Now, major countries are embarking on “tapering,” i.e., reducing their liquidity supply.

What will happen if the money suddenly starts to be withdrawn? Specifically, what will happen when the world's reserve currency, the dollar, begins to contract?

—

A retreat of the dollar to the US, a financial

crisis that emerging countries must face

—

Why does the dollar affect the world? Because the dollar is the reserve currency.

In 1973, the United States negotiated an agreement with Saudi Arabia to “transact in petrodollars.” The 20th century was the age of oil, and the world had to obtain dollars unconditionally to buy oil, so the dollar solidified its position as the global reserve currency.

(U.S. President Nixon on the left in 1973, Saudi King Faisal on the right)

For the past 40 years, the U.S. has overcome its domestic economic problems through quantitative easing (increasing money supply). The loosed dollars are exported abroad.

When more dollars circulate, their value decreases, and other countries that held dollars sit still and suffer the loss of foreign currency assets.

Conversely, when the US raises interest rates to keep up with inflation, the dollars that have been abroad return to the US. Neighboring countries must defend themselves by raising their interest rates higher than the US to avoid a dollar shortage, that is, a currency crisis. In the process, liabilities incurred in real estate and financial markets are aggravated and asset prices fall.

In other words, emerging countries are suffering in one way or another depending on the monetary policy of the United States. Examples are the national bankruptcy crisis in Latin America (Argentina, Mexico, Brazil) in the 1980s, the Asian financial crisis in the 1990s, and the financial crisis in China in 2008.

Emerging markets' currencies are depreciating as the US rate hikes move. For example, the Turkish lira, which was 8 liras to the dollar in June 2021, has now plummeted to 17 liras.

The money quickly released today becomes a debt that future generations will have to pay. Wealth grew rapidly during the pandemic, but the vulnerable suffer from inflation.

(Protesting the end of deferred tenant eviction in New York in January 2022. Source: AFP)

In fact, the rate of increase in U.S. house rents in 2021 was 19.8%, outpacing the rate of increase in house prices of 16.9%. Rents in New York and Miami jumped 40% from the previous year, so the difficulties of the low-income class are getting bigger.

Profits from Pain, Pandemic and Billionaires - Peace Issue

(Link to the previous Sunhak Peace Prize article on ‘Profits from Pain, Pandemic and Billionaires’)

The U.S. Consumer Sentiment Index, a measure of household purchase motivation, recently hit an all-time low of 50.2. Now there are fears that, even though interest rates are raised, inflation is not being stemmed and the economy has entered stagflation.

(Articles above about stagflation concerns)

Now the world is heading down a road we have not experienced before. As in the past 40 years, the United States will likely attempt to overcome the crisis by controlling dollar exports this time as well. It remains to be seen whether neighboring countries will continue to tolerate the burden.

Written by Sharon Choi

Director of Planning

Sunhak Peace Prize Secretariat