Carbon Tax is a tax imposed on the carbon content of fossil fuels, such as oil and coal, as a means to combat climate change. In this article, we’ll take a closer look at the meaning of carbon tax, how it works, and how it’s being implemented around the world.

―

Q. What is Carbon Tax?

―

A. Carbon Tax is a tax imposed on businesses based on the carbon emissions produced during the manufacturing goods and services. It establishes a baseline for emissions and charges for exceeding that limit.

Here is the definition of a carbon tax according to the Organisation for Economic Cooperation and Development (OECD):

A carbon tax is “an instrument of environmental cost internalisation.

It is an excise tax on the producers of raw fossil fuels based

on the relative carbon content of those fuels.”

● Effects of a Carbon Tax

Businesses face higher taxes for increased carbon emissions, and they will be incentivized to reduce emissions and use energy more efficiently by developing alternative energy sources and other carbon-reducing technologies.

Governments benefit by collecting revenue from carbon taxes, which can then be invested in clean energy development and climate adaption.

On the way to carbon neutrality to curb climate change, more countries are looking for ways to reduce their carbon emissions, and carbon tax can play a very important role in this process.

If you want to learn more about the state of our planet in crisis, Check out these articles! ↓↓↓ |

―

Carbon Tax vs. Emission Trading System

―

If you are confused about the difference between Carbon Tax and the Emission Trading System, you are not alone. Most countries that have introduced a Carbon Tax have also adapted the Emission Trading System (ETS). Let’s find out how they are different.

While a carbon tax sets a price on each unit of emissions without a limit to the amount that can be emitted, the Emission Trading System (ETS) defines a maximum level of pollution (a ‘cap’), therefore often called the cap-and-trade program. An ETS allocates a certain amount of credits to large greenhouse gas emitters and allows them to buy and sell any excess or surplus credits.

Carbon Tax | Emission Trading System |

- Levied directly on companies emitting greenhouse gases or producing fuels with emissions. - Higher taxes on goods and services with more emissions. | - Sets a cap on total emissions, requiring permits for businesses to emit greenhouse gases. - Price of a license fluctuates based on market dynamics. |

If you want to learn more about carbon policies, Check out this article! ↓↓↓ |

―

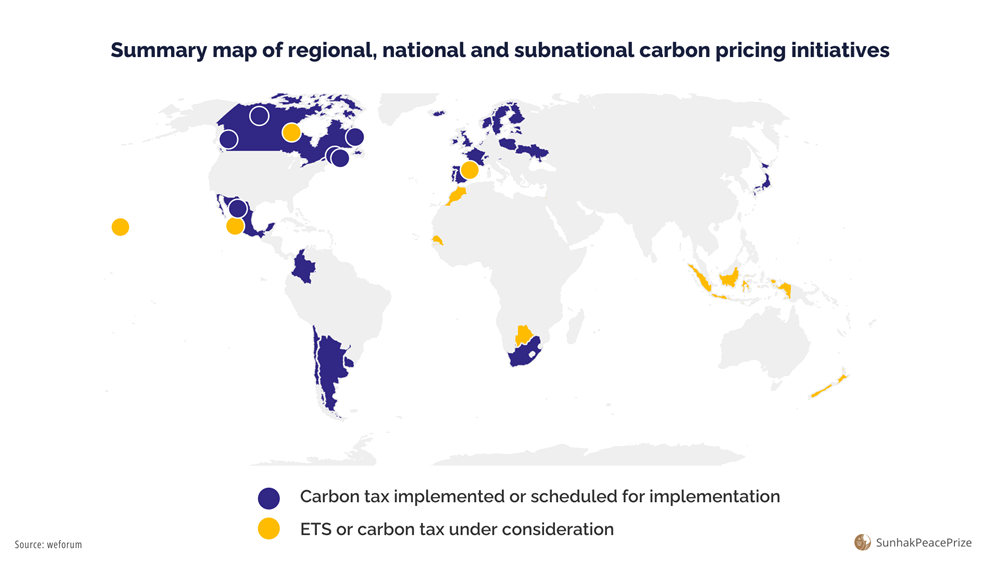

Carbon Pricing Initiatives Worldwide

―

Carbon tax was first introduced in Finland in 1990, followed by Sweden and Norway in 1991, Denmark in 1992, and Germany in 1999.

According to the German Federal Ministry for Environment, Germany has experienced a substantial decline in carbon emissions following the implementation of the carbon tax. In 1990, Germany’s carbon emissions totaled about 1,261 million tons, which decreased to 726 million tons in 2021, marking a reduction of about 42%.

This successful reduction can be attributed to a multifaceted approach, which includes the development of renewable energy sources, enhancements in energy efficiency, and the implementation of environmental protection and climate response policies. Other strategies, including the Emission Trading System, credit mechanisms, and internal carbon pricing, also contribute to the broader framework of carbon pricing policies.

As of June 2022, 68 carbon pricing instruments operate in 46 countries, comprising 36 carbon tax regimes and 32 Emission Trading Systems, according to the World Bank.

The increasing severity of climate change has prompted governments and businesses worldwide to intensify their endeavors in curbing carbon emissions. The global shift towards carbon neutrality and the regulation of carbon emissions reflects a collective response to the escalating challenges posed by climate change.

If you want to learn about the future of global climate, Check out this article! ↓↓↓ |

Source: World Bank

● European Union

The EU’s Emission Trading System covers 11,000 plants across member states, including the UK, Norway, Iceland, and Liechtenstein.

● China

China has become the world’s largest carbon market in 2021, three times the size of the European Union’s. China is on its way to soon covering more emissions that the rest of the world’s carbon market put together. Its goal is to reach carbon neutrality by 2060.

● United States

The U.S. is one of the biggest carbon emitting countries in the world. While lacking a national carbon tax, several U.S. states, including California, Oregon, Washington, Hawaii, Pennsylvania, and Massachusetts, have implemented carbon pricing schemes.

● India

India contributes to about 7% of the world’s carbon emissions and is the third largest emitter after China and the United States. India does not levy tax on carbon emissions directly, but it taxes imported and domestically produced thermal coal since 2010.

● Africa

African countries, including South Africa, Uganda, Nigeria, and Rwanda, are adopting carbon taxes. South Africa was one of the first emerging economies to introduce carbon tax in 2019, and other countries have joined in the efforts to reduce environmental pollution.

―

The Efficiency of Carbon Tax: A Crucial Climate Change Tool

―

Many economists advocate for a carbon tax as the most efficient and cost-effective method to combat climate change. By making high emitters pay more taxes, it encourages the transition to cleaner alternatives. The generated revenue supports environmental protection and sustainable energy development.

Currently, out of the nine threshold boundaries that must be preserved for sustainable human development, six of them are said to be at critical levels. It’s no secret that our reckless emissions are the main culprit behind global environmental degradation.

If you want to learn more about human impact on the planet, Check out this article! ↓↓↓ |

Reducing carbon emissions is crucial for preserving the planet and making our planet a safer place to live in for the future generations. Governments, businesses, and individuals can collectively make a difference by implementing policies, adopting sustainable practices, and reducing carbon footprints.

“We are the first generation to feel the impact of climate change and the last generation that can do something about it.”

-Anote Tong

Sunahk Peace Prize Laureate-

Related Articles: What are Planetary Boundaries? The Glaciers are Sending Us a Warning |

Written by Sharon Choi

Director of Planning

Sunhak Peace Prize Secretariat